All Regarding the Foreign Earned Revenue Exclusion: Maximizing Your Standard Deduction Perks

The Foreign Earned Revenue Exclusion (FEIE) presents an important opportunity for U.S. residents living abroad to lessen their tax obligation responsibilities. Recognizing the qualification standards is vital for those looking for to benefit from this exclusion. In addition, declaring the basic deduction can boost overall tax advantages. Nonetheless, handling this procedure entails careful attention to detail and an awareness of common risks. Checking out these facets can supply clearness and maximize potential tax obligation advantages.

Understanding the Foreign Earned Income Exemption (FEIE)

The Foreign Earned Revenue Exclusion (FEIE) allows united state residents and resident aliens working abroad to exclude a portion of their international incomes from federal income tax. This stipulation works as a monetary relief device, making it possible for expatriates to retain a bigger share of their earnings earned in international countries. By reducing taxed revenue, the FEIE helps reduce the burden of double taxation, as people may additionally undergo taxes in their host countries. The exemption applies just to made earnings, that includes incomes, salaries, and professional costs, while easy income and financial investment gains do not certify. To profit from the FEIE, individuals need to file particular forms with the internal revenue service, detailing their foreign revenues and residency - FEIE Standard Deduction. Understanding the subtleties of the FEIE can significantly influence financial preparation for U.S. people living overseas, making it crucial for expatriates to remain educated about this helpful tax obligation arrangement

Qualification Criteria for the FEIE

To receive the Foreign Earned Revenue Exclusion (FEIE), people should fulfill details qualification standards. This includes gratifying residency needs, passing the physical existence test, and establishing a tax home in an international country. Each of these aspects plays an essential role in establishing whether one can gain from the exemption.

Residency Requirements

Meeting the residency demands is important for individuals looking for to receive the Foreign Earned Revenue Exclusion (FEIE) To be qualified, taxpayers have to develop an authentic house in an international country or countries for an uninterrupted period that usually spans an entire tax year. This demand highlights the need of a much deeper connection to the foreign place, relocating beyond mere physical presence. Individuals must show their intent to live in the international nation and have actually developed their living situation there. Elements such as the length of stay, kind of housing, and neighborhood area participation are taken into consideration in determining residency. Meeting these criteria is vital, as failing to do so may disqualify one from taking advantage of the FEIE.

Physical Presence Examination

Developing eligibility for the Foreign Earned Revenue Exemption (FEIE) can likewise be attained with the Physical Existence Examination, which calls for people to be literally present in a foreign nation for at least 330 full days throughout a consecutive 12-month period. This test is beneficial for those that may not meet the residency need but still stay abroad. The 330 days have to be full days, indicating that any day invested in the United States does not count toward this total amount. It is essential for individuals to keep precise documents of their travel dates and locations to sustain their claims. Efficiently passing this examination can substantially minimize gross income and enhance financial outcomes for migrants.

Tax Obligation Home Place

Tax home location plays an important duty in establishing eligibility for the Foreign Earned Earnings Exclusion (FEIE) To qualify, a specific have to develop a tax home in an international nation, which suggests their key business is outside the USA. This is distinct from a plain home; the specific must perform their operate in the international country while preserving a substantial link to it. The internal revenue service requires that the taxpayer can demonstrate the intent to continue to be in the foreign area for a prolonged duration. Additionally, preserving a home in the united state can complicate qualification, as it might suggest that the individual's real tax home is still in the United States. Recognizing this requirement is crucial for maximizing FEIE advantages.

Just how to Assert the FEIE on Your Tax Return

Asserting the Foreign Earned Earnings Exemption (FEIE) on an income tax return calls for mindful interest to information and adherence to specific IRS guidelines. Taxpayers must initially validate qualification by fulfilling either the authentic home test or the physical presence examination. Once qualification is validated, they have to finish IRS Type 2555, which details foreign earned revenue and pertinent info regarding their tax home.

It is necessary to report all foreign income accurately and maintain ideal paperwork to sustain insurance claims. Taxpayers ought to likewise recognize the maximum exclusion limit, which goes through yearly modifications by the IRS. Filing Kind 2555 alongside the annual tax obligation return permits taxpayers to omit a part of their international incomes from united state taxes. It is suggested to seek advice from a tax specialist or IRS sources for upgraded information and assistance on the FEIE procedure, ensuring compliance and maximization of possible benefits.

The Standard Deduction: What You Required to Know

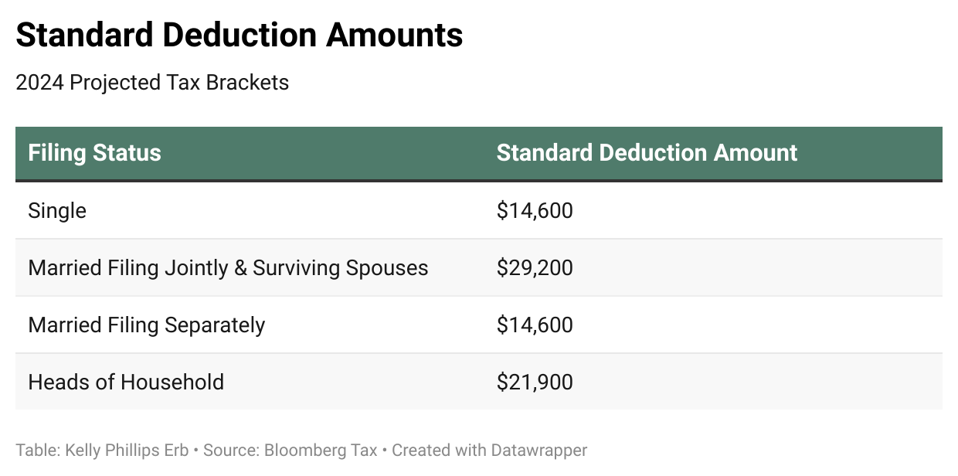

Just how does the common reduction influence taxpayers' overall economic situation? The common reduction offers as a substantial tax obligation benefit, minimizing gross income and possibly decreasing tax obligation responsibilities. For the tax obligation year 2023, investigate this site the typical reduction is evaluated $13,850 for solitary filers and $27,700 for wedded couples filing collectively. This reduction simplifies the declaring process, as taxpayers can go with it instead of itemizing deductions, which needs detailed record-keeping.

Taxpayers gaining foreign revenue might still claim the standard deduction, gaining from reduced gross income even while using the Foreign Earned Income Exclusion (FEIE) However, it is necessary to note that the conventional reduction can not be combined with itemized deductions for the exact same tax year. As a result, comprehending the conventional deduction allows taxpayers to make enlightened choices regarding their tax obligation methods, making best use of offered benefits while making certain compliance with internal revenue service policies

Strategies for Optimizing Your Deductions

Making the most of reductions under the Foreign Earned Revenue Exemption needs a clear understanding of gained income limitations and the advantages of declaring housing exclusions. Additionally, utilizing Kind 2555 efficiently can boost the capacity for significant tax obligation cost savings. These methods can significantly impact the general tax liability for migrants.

Understand Gained Income Limits

While many migrants seek to minimize their tax concern, comprehending the made income limitations is vital for properly leveraging the Foreign Earned Earnings Exclusion. The Internal Revenue Service (IRS) sets details thresholds that determine the maximum amount of foreign gained income eligible for exemption. For the tax year 2023, this limit is $120,000 per certified individual. Exceeding this threshold may cause taxes on the earnings over the limit, diminishing the advantages of the exemption. To make the most of deductions, expatriates ought to keep accurate documents of their international made income and assess their qualification for the exclusion try this web-site each year. Strategic planning around these limits can significantly enhance tax obligation financial savings, permitting expatriates to enhance their monetary scenario while living abroad.

Asserting Housing Exemption Conveniences

Several expatriates neglect the possible benefits of asserting the Housing Exclusion, which can greatly reduce their gross income. This exclusion enables individuals living abroad to subtract certain real estate expenditures from their gross earnings, making it less complicated to satisfy monetary commitments without incurring substantial tax obligation liabilities. To maximize this benefit, expatriates ought to confirm they qualify based upon their house and employment conditions. In addition, recognizing qualified expenditures-- such as lease, energies, and maintenance-- can improve the total deduction. Maintaining extensive documents of these expenses is crucial for substantiating cases. By purposefully navigating via the Housing Exclusion, expatriates can significantly reduce their tax problem and retain even more of their profits while living overseas, eventually improving their economic well-being.

Utilize Form 2555 Efficiently

Using Kind 2555 effectively can greatly improve the monetary advantages readily available to migrants, especially after benefiting from the Housing Exemption. This kind allows people to claim the Foreign Earned Revenue Exclusion, which can greatly reduce taxable revenue. To take full advantage of reductions, expatriates should validate they satisfy the certifications, including the physical presence examination or the bona fide house test. It is important to precisely report all foreign earned earnings and to keep complete records of eligibility. In addition, making use of the Housing Exemption in tandem with Kind 2555 can further decrease overall tax obligation. By comprehending the complexities of these kinds, expatriates can optimize their tax obligation scenario and maintain even more of their hard-earned revenue while living abroad.

Common Pitfalls to Stay Clear Of When Filing Your Tax Obligations Abroad

Often Asked Questions

Can I Declare Both FEIE and the Foreign Tax Obligation Credit History?

Yes, an individual can claim both the Foreign Earned Income Exemption (FEIE) and the Foreign Tax Obligation Debt (FTC) Nonetheless, they have to ensure that the exact same revenue is not utilized for both benefits to stay clear of dual benefits.

What Happens if I Go Beyond the FEIE Income Restriction?

Going Beyond the Foreign Earned Earnings Exclusion (FEIE) revenue limitation results in the ineligibility for the exemption on the excess quantity. This might cause gross income in the USA, needing suitable tax obligation filings.

Are There Any State Tax Obligation Implications for FEIE?

State tax obligation ramifications for the Foreign Earned Revenue Exemption (FEIE) vary by state. Some states might tire foreign earnings while others comply with federal exemptions, making it crucial for individuals to speak with state-specific tax obligation policies for clarity.

How Does FEIE Affect My Social Safety Perks?

The Foreign Earned Earnings Exemption (FEIE) does not straight impact Social Security benefits. However, income excluded under FEIE might influence the computation of typical indexed regular monthly profits, potentially influencing future advantages.

Can I Withdraw My FEIE Election After Claiming It?

Yes, a person can revoke their Foreign Earned Income Exemption (FEIE) political election after asserting it. This abrogation needs to be performed in creating and sent to the internal revenue service, adhering to specific standards and due dates.

Comprehending the Foreign Earned Earnings Exclusion (FEIE)

The Foreign Earned International Exclusion EarningsFEIE) allows U.S. permits and people aliens working abroad functioning exclude a leave out of part foreign earnings international incomes income taxRevenue Taxpayers making foreign revenue may still declare the common deduction, profiting from minimized taxable revenue also while utilizing the Foreign Earned Revenue Exclusion (FEIE) Optimizing deductions under the Foreign Earned Revenue Exemption requires a clear understanding of made income restrictions and the benefits of claiming real estate exemptions. While numerous migrants seek to reduce their tax obligation worry, recognizing the made earnings restrictions is necessary for efficiently leveraging the Foreign Earned Earnings Exemption. Exceeding the Foreign Earned Revenue Exclusion (FEIE) earnings restriction results in the ineligibility for the exclusion on the excess quantity.